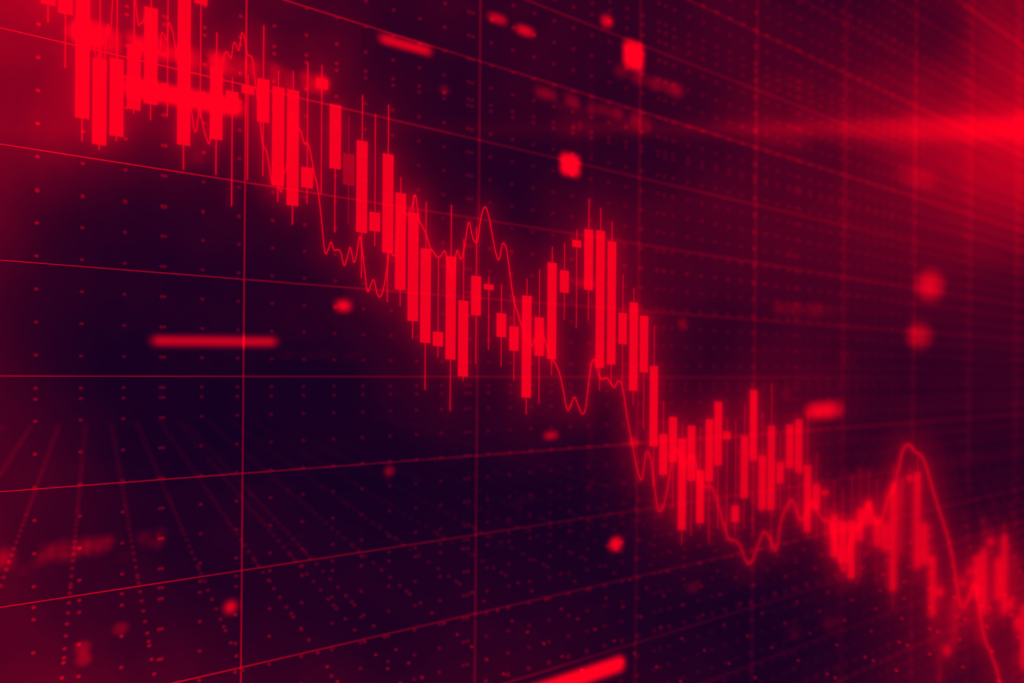

Indian share markets slid further for the second consecutive day on Feb 3rd after the Sensex suffered a sharp plunge of 319 points or 0.4 per cent to close at 77,186 and NIFTY plunged for a loss of 121 points of 0.5 per cent at close of 23,361 levels. Weakening cues from US President Donald Trump’s sweeping tariffs on Canada and Mexico and subsequently China spook investors; fears of trade war start mounting again.

GLOBAL TRADE WAR Fuels Market Troubles

The financial markets were rattled by the news, following US President Trump imposing a 25% tariff on imports from Canada and Mexico and a 10% levy on goods from China. The latter was part of a move the US President had been hinting at for weeks citing border security concerns and the drug trade.

Canada and Mexico threatened to retaliate. China was ready to take the tariffs to the World Trade Organization. The news of this sent shockwaves across global markets, triggering widespread selling.

U.S. stock futures fell, with S&P 500 and Nasdaq 100 futures down 1.6%, and Dow futures down over 1%. Asian markets were no different as Japan’s Nikkei 225 slid 3% and South Korea’s Kospi dropped 2.5%. Cryptocurrencies were not spared either—Bitcoin (BTC) was down over 4%, while Ethereum (ETH) fell by nearly 16%.

Broader Markets Stand Firm Amid Volatility

Broader Indian markets did outperform benchmark indices despite the mayhem. BSE Midcap increased 1%, while BSE Smallcap rose 1.8%. Sector-specific indices remained largely under pressure, though with Nifty IT and Nifty Auto managing modest gains of 0.5% and 0.1%, respectively.

The Nifty Metal index shed more than 2% following a sharp fall of base metal prices on the London Metal Exchange (LME) which was induced by a strong dollar. Amongst the major stocks, NALCO, Vedanta, and Jindal Stainless declined by as much as 4-6%.

This reflected in the selloff from the Nifty Oil & Gas index, which slid by 2.5% due to Jefferies lowering the price targets for India’s state-run OMCs on account of budgetary support being non-existent for under-recoveries. HPCL fell 6%, while BPCL and IOC declined by 4% each.

Mixed performance across individual stocks

Quarterly earnings updates and brokerage calls resulted in sharp movements in some individual stocks. GR Infra Projects fell 5% after reporting disappointing earnings. UPL jumped over 4% after Investec upgraded the stock to ‘buy’ from ‘sell’. The brokerage has increased its price target to Rs 700 from Rs 450, citing debt reduction efforts to be successful in FY25.

The significant laggards in the Nifty 50 pack were L&T, ONGC, Tata Consumer, Coal India, and Bharat Electronics, which fell between 2% and 5%. On the other hand, Bajaj Finance, M&M, Wipro, Shriram Finance, and Bajaj Finserv gained 2-5% each.

Expert Take and Technical Support

However, some remain optimistic despite the pervading market pessimism. “Every pullback or uptick is seen as an opportunity to cash out, as seen in today’s large-cap performances,” noted Ashish Bahety, Director of NAV Investment, on why he still holds a “cautious optimism” with the recent market reactions.

Bahety said that with internal challenges like land reforms and labor issues, India cannot replace China in the global supply chain. “While some sectors, like chemicals, may benefit, India cannot fully replace China in the global manufacturing ecosystem,” he added.

In the short term, Kranthi Bathini, director equity strategy at WealthMills Securities said his derivatives view was on the level of call positions at 24,000 and puts at 23,000. “So long as Nifty sustains above the 23,000 level, markets may stabilise at this level despite negative global cues,” Bathini noted.

Outlook: RBI Policy in Focus

With the Budget 2025 announcements behind, investors are now shifting focus to the Reserve Bank of India’s upcoming monetary policy decision on February 7. Market participants are keenly watching for signals regarding the central bank’s stance on interest rates and its approach to balancing inflationary pressures with economic growth amid ongoing market volatility.

With uncertainty remaining the order of the day in the world of global trade, market watchers expect continued turbulence across asset classes, where investors are bound to be cautious in the near term.

For more updates, visit satvnews.in.